6 Tips to Easily Improve Your Credit Score

If you’re looking for ways to boost your credit score, check out these useful tips on how to improve your credit to help reach your financial goals.

If your current score is less-than-perfect, don’t give up just yet — improving your credit score isn’t as hard as it might seem. Whether you’re just starting to build credit or looking to raise your score, these tips may help you on your journey to financial success.

How are credit scores calculated?

Imagine that your credit score is like a report card for lenders to see how responsible you are with money. Your score shows how likely you are to pay back what you borrow. Credit scores are typically calculated based on several things, with varying levels of impact assigned to each factor.

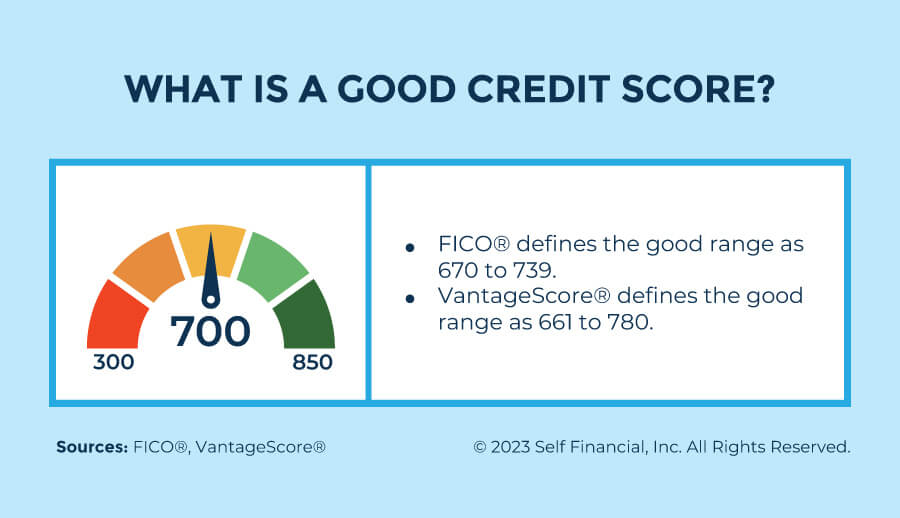

Typically represented as a three-digit number ranging from 300 to 850, the higher your score, the more favorably your creditworthiness is viewed. Each lender may have different criteria for assessing credit risk depending on the scoring model they use.

Factors that impact your credit score

- Payment history: This is the record of how timely you are in paying your bills. Payment history is a very important factor in calculating your credit score, making up 35% of your overall score. While paying on time builds good credit, late payments hurt your credit by leaving a negative mark on your credit report. That negative mark may stay on your report for up to seven years.

- Credit utilization: This measures how much of your available credit you’re using. It’s best to keep your credit utilization, the amount of credit you’re using compared to how much you have, below 30%. Using too much can lower your credit score.

- Length of credit history: This is the age of the accounts on your credit report, which makes up 15% of your credit score. For example, you may have a credit card that is 10 years old and a line of credit that has been open for six months. Older credit accounts can show lenders you’re experienced in handling credit, which is good for your score.

- Credit mix: This accounts for 10% of your overall credit score. Lenders like to see a mix of different types of credit, like credit cards and loans. Having a diverse credit mix shows you can manage different kinds of credit responsibly.

- Recent credit inquiries: This looks at any new credit applications you’ve made, like for a car loan or new credit card, which is 10% of your credit score. Too many recent credit applications can lower your score, so try to be mindful when shopping around.

Ways to improve your credit

Let’s explore six simple tips for boosting your credit score and taking control of your financial future.

1. Keep your credit utilization low

Keeping your credit utilization low is often one of the fastest ways to improve your credit score. Credit utilization is how much of your credit you’re using compared to the total you have available. Ideally, you want to keep your credit utilization as low as possible. Keeping credit card balances low is one of the best ways to do this.

Get strategic about it by paying down credit card balances before your billing cycle ends. Card issuers typically report balances to the credit bureaus on your statement date. Your statement date is when the credit card company sums up everything you’ve spent, paid off, or any interest you owe during the previous month and creates your bill. The due date is when your bill needs to be paid to avoid late fees or interest, so pay as much as you can before that day. Another way to keep your credit utilization low is to make extra payments during the billing cycle before the due date, as long as it fits within your budget.

2. Become an authorized user

Another straightforward way to improve your credit score is to become an authorized user on a friend or family member’s account. While not all credit card issuers allow adding authorized users, this may be especially useful if you’re unable to increase your credit limit or you have a short credit history.

The only downside is that you’ll be jointly responsible for paying off the card. So, if the primary user winds up with late or missed payments, it will show up on your credit report, too.

3. Pay your bills on time

Paying your bills on time is one of the most important factors in determining your credit score. In fact, on-time payments make up a whopping 35% of your score. Just one late or missed payment could stay on your report for up to seven years, so it’s important to do whatever you can to pay on time.

Here are some simple ways to help you keep payments on time:

- Make a list of all your bills.

- Review your due dates.

- Set up calendar alerts — or even write on a wall calendar — to remind yourself of upcoming due dates.

- Sign up for automatic payments (if you’re a OneMain customer, you can do this easily in your online account or mobile app).

4. Check your credit report

A single error on your credit report could get in the way of your score and fixing it could boost your score faster than you think. Luckily, there are more ways than ever to check your credit for free.

Once you have your reports, check for mistakes. Confirm the following basic information is correct before reviewing the specifics of each account:

- Name

- Address

- Social Security number

- Employment history

If you find a mistake, immediately dispute the credit report with the credit bureau.

5. Keep older accounts open

Similar to your employment history on a job application, your older credit accounts may signal your reliability to the credit bureaus and factor into the score the credit bureaus report.

Your credit history also makes up about 15% of your credit score, so it may help to keep older accounts open, even if you’re not using them.

Another credit score tip: longstanding credit accounts can contribute to your credit history, but closing one may increase your credit utilization rate, which lowers your score. So, there’s even more reason to hold onto older accounts.

Just be sure to weigh the pros against the potential cons of keeping older accounts open. For example, if having extra credit available tempts you to go on a shopping spree, it may be helpful for you to reconsider those longstanding credit cards.

6. Don’t apply for too much new credit

Opening up new credit accounts could have a dual effect on your credit score. On one hand, you’re increasing your overall credit limit, which is positive. On the other hand, each application for new credit could trigger a review of your credit history called a hard inquiry. Usually, when a lender runs a hard inquiry, your credit score takes a hit of up to 10 points.7

Since a hard inquiry can negatively impact your credit score, you might want to avoid applying for a lot of new credit in a short period of time. Too many hard inquiries at once, can be a red flag for lenders. They may view your actions as a plan to take on a lot of new debt. So, if you intend to apply for new credit, which could increase your score, try to spread out your applications.

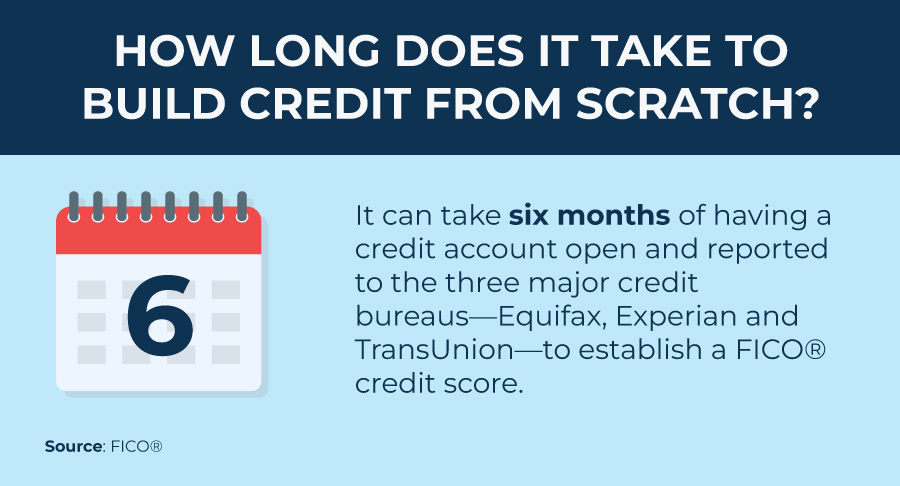

How long could it take to strengthen your credit score?

The time it takes to build up a credit score can vary depending on several factors, including how much damage there is to your credit, what your current financial situation is and what steps you take to improve it.

Consistently making responsible credit choices over time is the most effective way to rebuild your credit score.

You’re on your way

Improving your credit score quickly may be challenging, but making small changes over time can help make it more doable. Whether you’re just beginning to build credit or trying to rebuild your credit after an unexpected dip, it’s important to remember that it’s often a gradual process and patience is key. But equipped with the credit tips above, some focus, and a little patience, you may be on your way to a higher credit score — and all the financial perks that come with it.

If you are in need of rebuilding your credit history and equity, believe a creditor has wronged you, or you want to get out of debt now this website will open your eyes to hidden truth credit card companies, credit reporting agencies, and credit repair companies have been hiding from you.

If you are in need of rebuilding your credit history and equity, believe a creditor has wronged you, or you want to get out of debt now this website will open your eyes to hidden truth credit card companies, credit reporting agencies, and credit repair companies have been hiding from you.