7 Tips To Build Credit When You Have No Credit History

It may seem difficult to start building credit when you have none. But, no matter where your starting point is, it’s possible to build credit and have a credit score calculated as soon as three to six months from the start of your credit activity.

If you’re just getting started on your credit journey and have no credit history, you’ve come to the right place. In this article, we go over ways to start building your credit today.

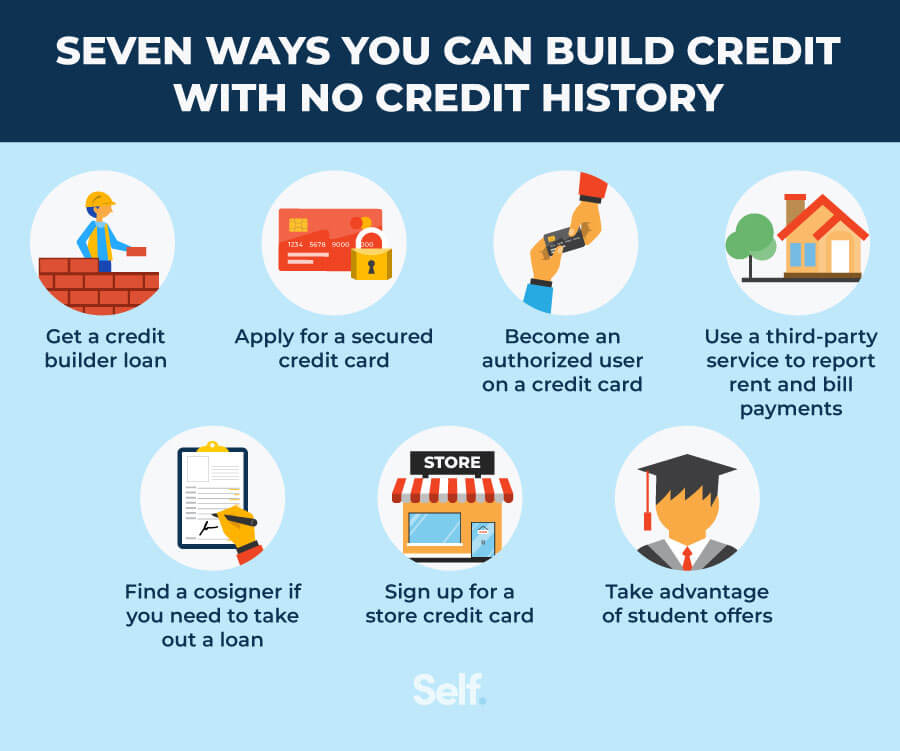

7 ways you can build credit with no credit history

When you have no credit history, it’s hard to know where to begin. Here are some ways to build credit history quickly when you’re just starting out.

1. Get a credit builder loan

A credit builder loan is a loan designed to help people with little or no credit history build their credit.

In contrast to a traditional installment loan, where you get a lump sum after you sign your agreement and then pay it back in installments, a credit builder loan secures your loan funds in a certificate of deposit (CD) or savings account after you are approved.

You then pay your monthly payments, which are reported to the credit bureaus. Once all your payments are made, you get your money (minus any applicable interest and fees).

A credit builder loan can contribute to your credit because your payments on it are reported to the credit bureaus. The Consumer Financial Protection Bureau released findings in 2020 from research it conducted regarding credit builder loans.

After studying data from an enrollment period of September 2014 to February 2015, CFPB found that opening a credit builder loan. without an existing loan, increased the likelihood of a person having a credit score by 24%.

Those same participants with no existing debt saw their credit scores increase by 60 points more than participants with existing debt. Also, the credit builder loan resulted in an average increase in participants’ savings balance of $253.

Self’s Credit Builder Account, for example, is a loan in a bank-held CD that you pay off in monthly installments. Each monthly payment is reported to all three credit bureaus, and, at the end of the period, you receive the money back, minus any interest and fees.

2. Apply for a secured credit card

A secured credit card is another credit product that can help you build credit. It works similarly to an unsecured credit card — both are lines of credit, allowing you to borrow money from the card issuer to make purchases when you want — but with a secured credit card, you provide a cash deposit upfront as collateral, typically placed in a savings account or certificate of deposit (CD). For example, a secured credit card with a $500 credit limit would require a $500 security deposit as collateral.

To obtain a secured credit card, you apply and, once approved, you then must put down a cash security deposit, which acts as your credit limit, and then you can use the card to make charges up to the amount you deposited. If you don’t already have a credit card account or cannot get approved for an unsecured credit card, a secured credit card is a worthwhile credit-building option.

The Self Visa® credit card is a secured credit card option with a few requirements for applying. You need an active Self Credit Builder Account (CBA) in good standing, a savings progress of $100 or more, and to have made three on-time monthly payments on your CBA. If you’re approved, you can use your savings progress towards your security deposit on the card.

3. Become an authorized user on a credit card

Becoming an authorized user on a friend or family member’s credit card can help you build credit, especially if they have an account in good standing. Being an authorized user means that you can make purchases with the account but you’re not legally responsible for making payments. Typically, you receive your own credit card and can piggyback off of the primary account holder’s credit to build your own credit history.

See if a trusted friend or family member with good credit would agree to add you to their account. Make sure that the primary cardholder pays the account as agreed, has had the account open for a while and maintains a low credit utilization ratio (CUR), the total revolving debt on the account divided by their credit limit.

Not all credit card companies report authorized users. So contact the credit card issuer and make sure the account is reported to the three major credit bureaus. Sometimes, authorized user activity isn’t reported, which, in the case of credit-building, defeats the purpose.

4. Use a third-party service to report rent and bill payments

If you make on-time monthly payments towards your rent and other bills, you can have that positive payment history count toward your credit by using a third-party reporting service. Though these bills aren’t usually factored into your credit report, a third-party reporting service makes them count by reporting your history to the major credit bureaus.

Find out if your landlord or property management company reports rent payments to the three major credit bureaus. If they don’t, you might need to pay for a reporting service yourself. Rent reporting services allow you to add report rent as well as other types of bills to your credit file, such as utilities and cell phone bills, which helps you build your credit history.

These two in particular only report positive payment history on the accounts you link, so late or missed payments won’t lower your credit score. Whatever service you choose, make sure the cost of subscribing is worth the benefit to your credit.

5. Find a cosigner if you need to take out a loan

If you’re having trouble getting approved for a personal loan, you can ask someone you trust to cosign it. With a cosigner, both parties share equal responsibility for the debt, and it appears on both parties’ credit reports.

A personal loan can positively affect your credit in several ways. First, making on-time payments on your loan over time gives you a positive payment history, one of the most important factors in calculating a credit score. Missed or late payments on a loan, on the other hand, may negatively impact your credit score, and can result in penalties, especially if your loan has a high interest rate.

A loan may also contribute to your credit mix. This credit scoring factor takes into account the types of credit you have, showing that you can manage a variety of credit products and accounts successfully. However, you shouldn’t take out different credit products just to add new credit to your credit mix — only the ones you really need to use.

Student loans are part of your credit mix and payment history, so making payments on them can be a great way to start building your credit. Since these are among some of the first types of credit you’ll receive, you can begin building a credit history by paying these on time and as agreed.

6. Sign up for a store credit card

A retail chain or department store credit card can help you build credit. These credit cards are usually easier to get than regular credit cards, and offer lower credit lines, making them a great starter card for beginners who don’t want to take on too much debt.

However, store cards often come with higher interest rates, so be especially careful in how you use them. They also won’t help your credit in the long term as much as a regular credit card since you’re limited as to where you can use them and generally come with lower spending limits.

7. Take advantage of student offers

Student credit cards are credit cards geared towards college students, and are generally designed to be a good first credit card for younger people who don’t have credit history. You don’t usually need collateral or a security deposit to open one.

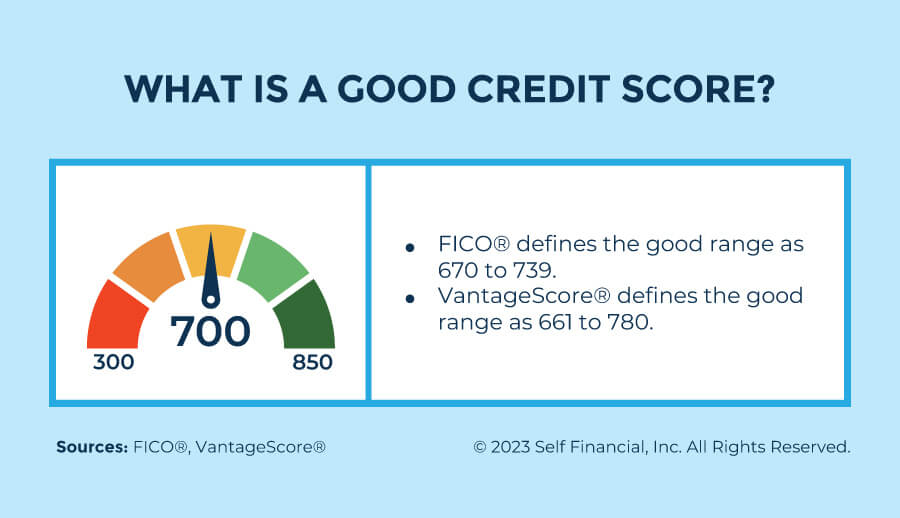

What is a good credit score?

A good credit score falls between 670 to 739 on the FICO® Score range, while a good credit score on the VantageScore® range falls somewhere between 661 to 780. What affects your credit score somewhat depends on the credit scoring model being used to calculate it. In general, the most important factors in your credit score are:

- Your payment history

- Your credit usage

- Your length of credit history

- The types of accounts you have

- Your recent activity

The two most commonly used credit scoring models, FICO® and VantageScore®, weigh these factors differently and call them by different names, but much of the information they consider in calculating your credit score is the same, or at least overlapping. Each scoring model gets its information on your credit activity from what’s reported to the three main credit bureaus — Experian, Equifax and TransUnion.

Here’s a full breakdown of credit score ranges and what they mean according to the two major credit scoring models:

| Credit Score Category | FICO®[[10]](#sources) | VantageScore®[[11]](#sources) |

|---|---|---|

| Excellent | 800+ | 781–850 |

| Very good | 740–799 | N/A |

| Good | 670–739 | 661–780 |

| Fair | 580–669 | 601–660 |

| Poor | <580 | 500–600 |

| Very poor | N/A | 300–499 |

How long does it take to build credit if you have none?

How long it takes you to build credit depends on your unique situation, and building excellent credit — or any level of credit — always takes time. When it comes to getting a credit score, how long that takes mostly depends on the credit scoring model used.

To generate a FICO® score, you need an account that is at least six months old and has been active in the past six months. For a VantageScore®, on the other hand, you only need one active account, even if the account has only been open a month.

If you don’t have an active credit account, you may be considered credit invisible, meaning you haven’t had a credit report generated by the credit bureaus yet, or unscored, meaning you don’t have enough active credit history to produce a score.

How to responsibly build and maintain credit

Whether you want a car loan, mortgage or personal loan now or in the future, lenders will need to perform a credit check. So knowing where you stand with your personal finances and credit history is important, and building good credit habits now may be a great start to a strong credit history.

There’s not one single way to get good credit, but following the right credit habits over time — like only applying for the credit you need, making on-time monthly payments and keeping your revolving utilization low — will help you get there.

And, if your credit-building journey gets challenging, Self’s credit products are here to support you along the way.

Disclaimer: FICO is a registered trademark of Fair Issac Corporation in the United States and other countries.

Sources

- Experian. “How Long Does It Take to Build Credit?” https://www.experian.com/blogs/ask-experian/how-long-does-it-take-to-build-credit/. Accessed December 19, 2022.

- Consumer Financial Protection Bureau. “CFPB Study Shows Financial Product Could Help Consumers Build Credit,” https://www.consumerfinance.gov/about-us/newsroom/cfpb-study-shows-financial-product-could-help-consumers-build-credit/. Accessed December 19, 2022.

- myFICO®. “How Can I Start Building My Credit History?” https://www.myfico.com/credit-education/faq/improving-a-score/building-credit-history. Accessed December 19, 2022.

- Experian. “Credit Card Authorized User: What You Need to Know,” https://www.experian.com/blogs/ask-experian/what-is-credit-card-authorized-user/. Accessed December 19, 2022.

- Experian. “Build Credit History By Paying Your Rent On Time,” https://www.experian.com/rentbureau/rental-payment. Accessed December 19, 2022.

- myFICO®. “How to Build Credit,” https://www.myfico.com/credit-education/credit-scores/how-to-build-credit. Accessed December 19, 2022.

- myFICO®. “Types of Credit and How They Affect Your FICO® Score,” https://www.myfico.com/credit-education/credit-scores/credit-mix. Accessed December 19, 2022.

- National Foundation for Credit Counseling. “Are Retail Store Cards Bad For Your Credit?” https://www.nfcc.org/blog/are-retail-store-credit-cards-bad-for-your-credit/. Accessed December 19, 2022.

- Investopedia. “What Is a Student Credit Card?” https://www.investopedia.com/what-is-a-student-credit-card-5191388. Accessed December 19, 2022.

- myFICO®. “What is a Credit Score?” https://www.myfico.com/credit-education/credit-scores. Accessed December 19, 2022.

- VantageScore®. “The Complete Guide to Your VantageScore®,” https://vantagescore.com/press_releases/the-complete-guide-to-your-vantagescore/. Accessed December 19, 2022.

- myFICO®. “What are the minimum requirements for a FICO® score?” https://www.myfico.com/credit-education/faq/scores/fico-score-requirements. Accessed December 19, 2022.

- Experian. “What Is a Good Credit Score?” https://www.experian.com/blogs/ask-experian/credit-education/score-basics/what-is-a-good-credit-score/. Accessed December 19, 2022.

- Consumer Financial Protection Bureau. “How do I get and keep a good credit score?” https://www.consumerfinance.gov/ask-cfpb/how-do-i-get-and-keep-a-good-credit-score-en-318/. Accessed December 19, 2022.